How ISO Certification Strengthens Manila’s Banking and Financial Sector

Introduction

Are you aware that the compliance failures and data breaches of financial institutions are costing them $18 million every year on average? For Manila, which is the financial hub of the Philippines, the numbers are grimmer as Manila is transforming into one of the leading financial centers of Southeast Asia.

ISO certification in Philippines is a solution for banks, fintech corporations, and even insurance companies to win customer trust, protect data, and operate more efficiently.

This blog will shed light on the transforming power of ISO certification on Manila’s financial services landscape, which certifications are indispensable, and how the best ISO consultants in the Philippines, Maxicert, can help your business achieve its goals.

In today’s fast-moving and highly digital financial world, ISO certification has become a powerful tool for improving trust, security, and efficiency, especially in major hubs like Manila, the financial capital of the Philippines. Banks, fintech companies, insurance firms, and other financial institutions in Manila are now embracing ISO standards to stay competitive, protect sensitive customer data, and comply with increasingly strict regulations.

Request A Free Quote

The Importance of Manila’s Banking Industry Having an ISO Certification

- Build and Bolster Customer Trust

A bank’s ISO certification stamp indicates that the institution follows internationally accepted practices for quality, security, and risk management. This guarantees customers that their financial and personal information will be safeguarded. For instance, a study conducted recently showed that 80% of people prefer to be served by ISO certified organizations due to their perceived reliability.

- Take Down Cybersecurity Risks

Cybercriminals are drawn to the financial sector. ISO/IEC 27001 certification increases the organization’s data protection practices, decreases vulnerabilities, enhances protective measures, and helps in risk mitigation. A Manila-based fintech startup reported a 60% drop in cybersecurity incidents after it attained this certification.

- Improve Efficiency, Cut Costs, and Streamline Processes

ISO 9001 (Quality Management System) is a standard that mandates organizations to manage internal processes optimally, cut down on waste, and reduce errors. A bank in the region, which is ISO certified, reported a 20% increase in operational efficiency and a considerable decline in errors made during transactions.

- Make Adherence to Regulations Easier

Manila’s financial sector is subject to local laws in addition to international standards. With the help of ISO guidelines, organizations are able to fulfill compliance requirements effectively while mitigating risks linked to non-compliance penalties.

Essential ISO Standards For Financial Institutions In Manila

Standards can surely bring about improvement in your organization. Below are the certifications you need to prioritize:

- ISO 9001 – Quality Management System

- Advantages: Enhances customer satisfaction; improves service delivery, and encourages continuous improvement.

- Manila-based microfinance institution achieved a 30 percent increase in repeat clients by utilizing ISO 9001 in improving its loan approval processes.

- ISO/IEC 27001 – Information Security Management

- Advantages: Enhances data security and compliance with data privacy provisions while mitigating breach risks.

- Digital Bank of the Philippines was able to significantly reduce customer complaints regarding fraud incidents using ISO/IEC 27001.

- ISO 22301 – Business Continuity Management

- Advantages: Improves disaster response and enables continued operations amidst disruptions.

- An insurance provider capitalized on ISO 22301 to ensure service continuity during Typhoon Odette, reducing business losses.

- ISO 31000 – Risk Management

- Advantages: Systematic risk identification, mitigation, and management. Improves decision-making under stressful situations.

- A local investment firm was able to avoid losses during the economic downturns by using ISO 31000 to improve its risk forecasting.

How ISO Certification Gives an Advantage for Financial Companies in Manila

- Increase Your Company’s Goodwill

The very benefit of greed is that it will result in an improvement in brand reputation. It acts as a mark of goodwill and increases customer trust for companies that attain it, along with boosting the attractiveness to the stakeholders and employees of the firm.

- Expand Global Market Reach

Companies that have ISO certification gain an edge in international competitiveness as they have an easier qualification in getting their credentials lazer’d by foreign companies.

- Nurture Triad Impact

ISO laid policies reward impetus of supervising, recovering, and innovating as ISO standards make policies, patterns, and demands for associates.

- Drives the Accuracy of Work Performed

Even though the firm sets some predefined criteria like defined systems or standards, the firm is not bound by fraudulent activities or wasteful depletion of resources.

- Remove Obstacles to Achieving Financial Goals

ISO certification permits one to avail of quicker augmentation in designing protective, amplifying bounds(lines) systems made available to fill the gaps of the rapidly evolving digital finance arena in Manila.

Key ISO Standards for Banking and Financial Sector in the Philippines

| ISO Standard | Full Name | Purpose | Why It Matters for Manila’s Financial Sector |

|---|---|---|---|

| ISO 9001 | Quality Management System | Improves service quality, customer satisfaction, and operational consistency | Ensures customer trust and efficient processes in competitive finance market |

| ISO 27001 | Information Security Management System | Secures sensitive data and protects against cyber threats | Vital for protecting customer and transaction data in banks and fintech firms |

| ISO 22301 | Business Continuity Management | Prepares institutions to recover from disruptions or disasters | Keeps financial services running during crises or cyber-attacks |

| ISO 20000 | IT Service Management | Optimizes IT support, service delivery, and incident management | Enhances digital service reliability in mobile banking and online finance |

| ISO 31000 | Risk Management | Provides a framework to manage operational and financial risks | Helps banks comply with regulatory demands and reduce financial exposure |

| ISO 14001 | Environmental Management | Manages environmental responsibilities and compliance | Useful for green banking and sustainability-driven financial operations |

Why Choose Maxicert as Your Partner for ISO Certification?

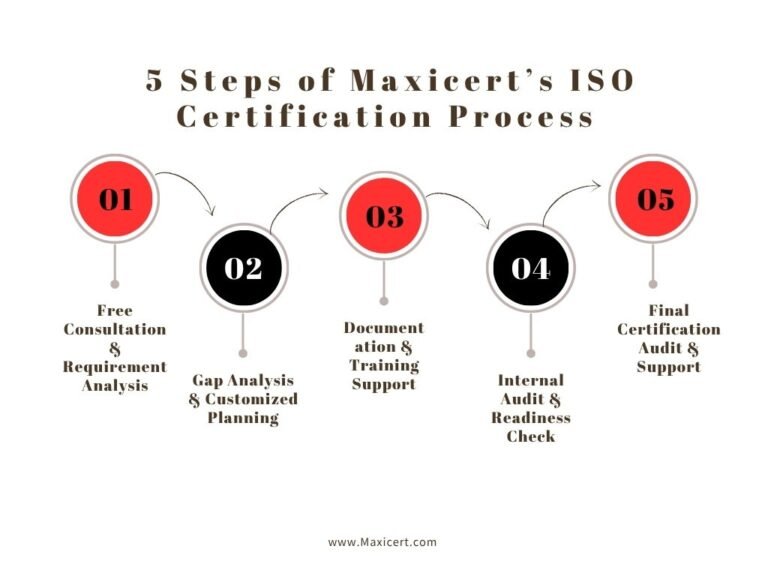

With the swift access to ISO Certification for Financial Institutions in Manila, Maxicert is custom-tailored to your needs. Here’s how we differentiate ourselves:

- Specialized solutions for the banking and finance sectors.

- Auditors and consultants who are certified and possess relevant experience.

- Complete assistance, including gap analysis, documentation, and audit reviews.

- Cost-effective and competitive package pricing.

- Quick timelines for certification, comprehensive support after certification, and ongoing assistance.

Why Now Is the Best Time to Get Certified

With rising competition, stricter cybersecurity regulations, and increased customer demands, the time to act is now. ISO certification future-proofs your business, ensuring resilience and relevance in a fast-evolving financial landscape.

Conclusion

ISO certification is not just a requirement; it’s a roadmap for sustainable growth and success. For Manila’s finance sector, adopting ISO standards ensures trust, efficiency, and global competitiveness.

At Maxicert, we take the complexity out of ISO certification. With tailored strategies, industry expertise, and end-to-end support, we make certification not just achievable but transformative for your organization.

Your path to excellence starts here.

Contact Maxicert today, and secure your place as a leader in Manila’s financial sector.

Get In Touch

Get In Touch

Get In Touch

Need A Free Estimate?

Get a free consultation and Checklist to get certified for ISO , HALAL, CE Mark Certification.

FAQ

What is ISO Certification in the financial sector?

ISO certification ensures that banks and financial firms follow international standards for quality, security, and risk management.

Which ISO is best for data security in banking?

ISO/IEC 27001 is the global standard for information security management and is ideal for banks and fintech companies.

How long does it take to get ISO certified in Manila?

The process typically takes 4 to 8 weeks, depending on the size of your organization and the chosen ISO standard.

How can Maxicert help with ISO certification in the Philippines?

Maxicert provides full ISO support including training, documentation, audits, and certification—making us one of the best ISO consultants in Manila.